|

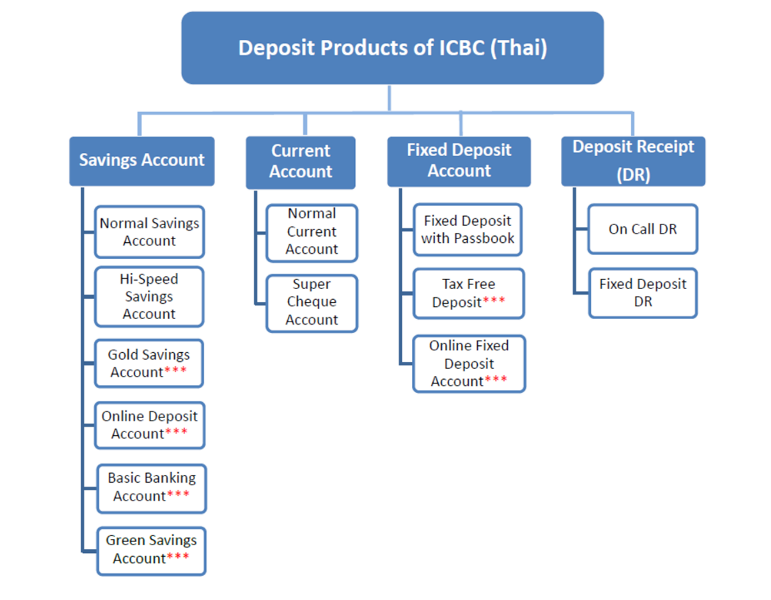

A. Savings Account

1. Normal Savings Account

| Product name |

Normal savings account |

| Benefits |

•Withdraw any time with no limits on the number of transactions.

•Deposit cash and/or cheque into your account through E-zy Card at any counter of BBL and KBANK free of charge. (Minimum deposit is 10,000 Baht per transaction) |

| Interest rate (% p.a.) |

0.700%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest payment frequency |

•Daily basis interest calculation

•Paid twice a year, in June and December |

| Initial deposit amount |

1,000 Baht. |

| Account maintenance fee |

50 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 1,000 Baht) |

| Conditions |

- |

| Warning |

• Deposit in/withdrawal from account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• The total amount of Interest income incurred from all savings deposit account with all banks exceed 20,000 Baht will be charged income tax 15%

• Issuance of new passbook (for lost) : 100 Baht each

• In case there is no account movement for more than 12 consecutive months, the Bank reserves the right to temporarily suspend any transactions until the account owner contacts the Bank |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

2. Hi-Speed Savings Account

| Product name |

Hi-Speed Savings Account |

| Benefits |

•Withdraw any time with no limits on the number of transactions.

•Higher interest rates than a normal savings deposit account.

•Deposit cash and/or cheque into your account through E-zy Card at any counter of BBL and KBANK free of charge. (Minimum deposit is 10,000 Baht per transaction) |

| Interest rate (% p.a.) |

0.700% - 0.800%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest rate Detail (% p.a.) |

| • Amount Less than 10,000,000 Baht |

0.800% |

| • From 10,000,000 Baht upward |

0.700% |

|

| Interest payment frequency |

• Daily basis interest calculation

• Paid twice a year, in June and December |

| Initial deposit amount |

10,000 Baht |

| Account maintenance fee |

50 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 5,000 Baht) |

| Condition |

1 account per 1 customer. |

| Warning |

• Deposit in/withdrawal from account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• The total amount of Interest income incurred from all savings deposit account with all banks exceed 20,000 Baht will be charged income tax 15%

• Issuance of new passbook (for lost) : 100 Baht each

• In case there is no account movement for more than 12 consecutive months, the Bank reserves the right to temporarily suspend any transactions until the account owner contacts the Bank |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

3. Gold Savings Account

| Product name |

Gold Savings Account |

| Benefits |

•Withdraw any time with no limits on the number of transactions.

•Higher interest rates than a Normal savings and a Hi-Speed savings deposit accounts.

•Deposit cash and/or cheque into your account through E-zy Card at any counter of BBL and KBANK free of charge. (Minimum deposit is 10,000 Baht per transaction) |

| Interest rate (% p.a.) |

0.800% - 1.450%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (% p.a.) |

Step-up interest rate that increases according to the amount of deposit. |

| • Amount not over 10,000,000 Baht |

1.450% |

| • Amount over 10,000,000 Baht |

0.800% |

|

| Interest payment frequency |

•Daily basis interest calculation

•Paid twice a year, in June and December |

| Initial deposit amount |

10,000 Baht |

| Account maintenance fee |

50 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 5,000 Baht) |

| Condition |

•For individual customers only.

•1 account per 1 customer.

•“For”, “By”, body of persons and all joint accounts (“And”, “Or”) are not allowed. |

| Warning |

• Deposit in/withdrawal from account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• The total amount of Interest income incurred from all savings deposit account with all banks exceed 20,000 Baht will be charged income tax 15%

• Issuance of new passbook (for lost) : 100 Baht each

• In case there is no account movement for more than 12 consecutive months, the Bank reserves the right to temporarily suspend any transactions until the account owner contacts the Bank |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

Submit Sales Sheet to customers |

4. Online Deposit Account

| Product name |

Online Deposit Account |

| Benefits |

•Withdraw any time with no limits on the number of transactions.

•Higher interest rates than all savings deposit account. |

| Interest rate (% p.a.) |

1.550%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest payment frequency |

•Daily basis interest calculation

•Paid twice a year, in June and December |

| Initial deposit amount |

No minimum initial deposit amount (but must be more than zero baht) |

| Account maintenance fee |

None |

| Condition |

•1 account per 1 customer.

•“For”, “By”, body of persons and all joint accounts (“And”, “Or”) are not allowed.

•Online Deposit Account can be opened via ICBC Personal Internet Banking or Personal Mobile Banking service (e-Banking Channel) only. |

| Warning |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

Submit Sales Sheet to customers |

5. Basic Banking Account

| Product name |

Basic Banking Account |

| Benefits |

Withdraw any time with no limits on the number of transactions. |

| Interest rate (% p.a.) |

0.700%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest payment frequency |

•Daily basis interest calculation

•Paid twice a year, in June and December |

| Initial deposit amount |

No minimum initial deposit amount |

| Account maintenance fee |

None (throughout the period of Basic Banking Account status) |

| Condition |

• Eligible to pen this account are persons holding valid National Welfare Cards or Thai nationals aged 65 and above.

• 1 account per 1 customer.

• “For”, “By”, body of persons and all joint accounts (“And”, “Or”) are not allowed. |

| Warning |

• Deposit in/withdrawal from account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• The total amount of Interest income incurred from all savings deposit account with all banks exceed 20,000 Baht will be charged income tax 15%.

• The Cardholder shall pay for the fees related to the use of the ICBC Debit Card, at the rate and pursuant to the terms and conditions announced by the Bank.The Bank reserves the right to convert Basic Banking Account to Normal Savings Account. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

Submit Sales Sheet to customers |

6. Green Savings Account

| Product name |

Green Savings Account |

| Benefits |

• Withdraw any time with no limits on the number of transactions.

• Higher interest rates than a normal savings deposit account.

• A service fee exemption when requesting an account statement. |

| Interest rate (% p.a.) |

0.800%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (% p.a.) |

• 0.800% for every deposit amount |

| Interest payment frequency |

• Daily basis interest calculation

• Paid twice a year, in June and December |

| Initial deposit amount |

No minimum initial deposit amount required |

| Account maintenance fee |

50 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 1,000 Baht) |

| Condition |

• Green Savings Account is a Savings Account without passbook.

• For individual customer only.

• 2 accounts per 1 customer.

• “For”, “By”, body of persons and all joint accounts (“And”, “Or”) are not allowed.

• Customers must apply for Personnel Internet Banking service through the Bank’s website or Mobile Banking Application to view account movements.

• Customers must apply for a Debit Card service |

| Warning |

• Deposit in/withdrawal from account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• The total amount of Interest income incurred from all savings deposit account with all banks exceed 20,000 Baht will be charged income tax 15%

• In case there is no account movement for more than 12 consecutive months or the identity documents, which were provided to the Bank have expired. The Bank reserves the right to suspend any transactions with a prior notice until the account owner contacts the Bank. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

Submit Sales Sheet to customers |

B. Current Account

1. Normal Savings Account

| Product name |

Normal Current Account |

| Benefits |

• Convenient payments by using cheques

• No limit for cheque cashing at home branch and up to THB 200,000 at non-home branches

• Monthly statement to keep you informed on all transactions

• Deposit cash and/or cheque into your account through E-zy Card at any counter of BBL and KBANK free of charge. (Minimum deposit is 10,000 Baht per transaction) |

| Interest rate (% p.a.) |

0.00%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest payment frequency |

- |

| Initial deposit amount |

10,000 Baht |

| Account maintenance fee |

100 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 1,000 Baht) |

| Conditions |

- |

| Warning |

• Deposit in Current account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• Withdrawal from Current account by cheque in case of withdrawal cash or depositing into the account (Not waiting for clearing)

– Other branches in the same region (Maximum 200,000 Baht/Cheque), the Bank will charged 10 Baht/every 10,000 Baht (Minimum 20 Baht)

– Other branches in other regions (Maximum 200,000 Baht/Cheque), the Bank will charged 20 Baht/every 10,000 Baht (Minimum 20 Baht) plus transaction fee 20 Baht.

• Withdrawal from Current account by cheque in case of depositing into the account at other branches in the other regions (Waiting for same-day clearing), the Bank will charged 0.10% of amount stated on cheque (Minimum 10 Baht)

• In case there is no account movement for more than 12 consecutive months or the identity documents, which were provided to the Bank have expired. The Bank reserves the right to suspend any transactions with a prior notice until the account owner contacts the Bank. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

2. Super Cheque Account

| Product name |

Super Cheque Account |

| Benefits |

• Higher interest rate than regular savings account

• Convenient payments by using cheques

• No limit for cheque cashing at home branch and up to THB 200,000 at non-home branches

• Monthly statement to keep you informed on all transactions

• Deposit cash and/or cheque into your account through E-zy Card at any counter of BBL and KBANK free of charge. (Minimum deposit is 10,000 Baht per transaction) |

| Interest rate (% p.a.) |

0.700% - 0.800%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest rate Detail (% p.a.) |

| • Amount Less than 10,000,000 Baht |

0.800% |

| • From 10,000,000 Baht upward |

0.700% |

|

| Interest payment frequency |

• Daily basis interest calculation

• Paid twice a year, in June and December |

| Initial deposit amount |

50,000 Baht |

| Account maintenance fee |

100 Baht/ month (For account that is inactive more than 12 consecutive months and average monthly outstanding balance of less than 5,000 Baht) |

| Condition |

Overdraft is not applicable with this account |

| Warning |

• Deposit in Current account at other branches in other regions, the Bank will charged 10 Baht/every 10,000 Baht (Minimum 10 Baht, Maximum 1,000 Baht) plus transaction fee 20 Baht.

• Withdrawal from Current account by cheque in case of withdrawal cash or depositing into the account (Not waiting for clearing)

– Other branches in the same region (Maximum 200,000 Baht/Cheque), the Bank will charged 10 Baht/every 10,000 Baht (Minimum 20 Baht)

– Other branches in other regions (Maximum 200,000 Baht/Cheque), the Bank will charged 20 Baht/every 10,000 Baht (Minimum 20 Baht) plus transaction fee 20 Baht.

• Withdrawal from Current account by cheque in case of depositing into the account at other branches in the other regions (Waiting for same-day clearing), the Bank will charged 0.10% of amount stated on cheque (Minimum 10 Baht)

• In case there is no account movement for more than 12 consecutive months or the identity documents, which were provided to the Bank have expired. The Bank reserves the right to suspend any transactions with a prior notice until the account owner contacts the Bank. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

C. Fixed Deposit Account

1. Fixed Deposit Account with Passbook

| Product name |

Fixed Deposit Account with Passbook |

| Benefits |

Deposits according to the period of time with interest rates higher than Savings Account |

| Interest rate (%p.a.) |

1.600% - 2.300%* based on deposit term (As of 19 October 2023)

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (%p.a.) |

| Deposit Period |

Interest Rate (% p.a.)* |

| 3 Months |

1.600% |

| 6 Months |

1.800% |

| 12 Months |

1.900% |

| 18 Months |

2.100% |

| 24 Months |

2.250% |

| 36 - 48 Months |

2.300% |

|

| Deposit Term |

3, 6 , 12, 18 , 24 and 36-48 Months |

| Initial deposit amount (Baht) |

• 50,000 Baht

• Subsequent deposit shall not be less than 10,000 Baht.

• To receive periodic interest payment, the amount of each deposit shall not be less than 500,000 Baht with a minimum deposit period of 6 months. |

| Interest rate for non-compliant deposit |

The Bank will pay interest at the rate of 0.20% p.a. to the actual deposit period if the deposit is withdrawn prior to its maturity date. |

Account renewal upon maturity

|

On the maturity date, if the Customer has not otherwise notified the Bank, the deposit will be automatically renewed for the same deposit term and the normal interest rate as per the Bank’s announcement at that time will be applied. |

| Account maintenance fee |

None |

| Condition |

- |

| Warning |

•Partial withdrawals are not allowed

•Withdrawals at any branches apart from the branch where the account was opened are not allowed

•Interest income will be deducted 15% interest tax. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

2. Tax Free Account

| Product name |

Tax Free Fixed Deposit |

| Benefits |

Simply make equal monthly deposits for 24 or 36 consecutive months to receive the tax exemption privilege |

| Interest rate (%p.a.) |

2.600% - 2.700%* based on deposit term (As of 19 October 2023)

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

Interest Rate Detail

(% p.a.) |

• 24 Months: 2.600%

• 36 Months: 2.700% |

| Deposit Term |

24 and 36 Months |

| Initial deposit amount (Baht) |

Minimum initial deposit is 1,000 Baht and the maximum is 25,000 Baht.

Deposit Period

(No. of Months) |

Deposit Amount (each month) |

| Minimum (Baht) |

Maximum (Baht) |

| 24 months |

1,000 |

25,000 |

| 36 months |

1,000 |

16,500 |

(deposit amount shall be in multiple of 500 Baht only)

Equal monthly deposits are required for 24 or 36 consecutive months to receive the tax exemption privilege.

|

| Interest rate for non-compliant deposit |

•Up to 2 missed monthly deposits are allowed, of which deposits can still be made for the absent 2 months. The maturity date will then be extended accordingly while the special interest rate with tax exemption will still apply.

•For 3 or more missed deposits, the regular savings interest rate per the Bank’s announcement at the time of the account opening according to the actual deposit period less withholding tax 15 percent will be applied. |

| Interest rate for withdrawal before maturity |

•Deposit period less than 3 months from the date of account opening, there will be no interest paid.

•Deposit period from three months onwards, regular savings interest rates will be applied according to the actual deposit period, less the withholding tax. |

| Account renewal upon maturity |

On the maturity date, the Bank shall transfer the principal and interest to the Savings account or Current account with the same account name as Tax Free fixed deposit and the Tax Free Fixed Deposit account will be closed |

| Condition |

- |

| Warning |

•Monthly deposits are required until the deposit term is completed.

•Partial withdrawals are not allowed.

•The total amount of Interest income incurred from savings account used for auto transfer service and all savings account with all banks exceed 20,000 Baht will be charged income tax 15%. |

| Contact us |

Call ICBC (Thai) Center at 02-629-5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

Submit Sales Sheet to customers |

3. Online Fixed Deposit Account

| Product name |

Online Fixed Deposit Account for Personal Customers |

| Benefits |

Higher interest rates than a Fixed Deposit Account with passbook. |

| Interest rate (%p.a.) |

1.650% - 2.350%* based on deposit term (As of 19 October 2023)

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (% p.a.) |

| Deposit Period |

Interest Rate (% p.a.)* |

| 3 Months |

1.650 |

| 6 Months |

1.850 |

| 12 Months |

1.950 |

| 18 Months |

2.150 |

| 24 Months |

2.300 |

| 36 - 48 Months |

2.350 |

|

| Deposit Term |

3 - 48 Months |

| Initial deposit amount |

No minimum initial deposit amount (but must be more than zero baht). |

| Interest rate for non-compliant deposit |

The Bank will pay interest at the rate of 0.20% p.a. to the actual deposit period if the deposit is withdrawn prior to its maturity date. |

| Account renewal upon maturity |

Choose from the deposit term from the table above. The interest rate is per the Bank’s announcement at the time of the account renewal. Or transfer the whole deposit amount back to the savings account. |

| Account maintenance fee |

None |

| Condition |

- |

| Warning |

Interest tax 15 % |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

D. Deposit Receipt (DR)

1. On Call

| Product name |

DR: On Call |

| Benefits |

Higher interest rate than regular savings account, even with on call deposit. |

| Interest rate (%p.a.) |

0.700%* As of 19 October 2023

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (% p.a.) |

0.700% for every deposit amount |

| Deposit Term |

No term |

| Initial deposit amount (Baht) |

50,000 Baht |

| Account maintenance fee |

None |

| Condition |

- |

| Warning |

•Withdrawals at any branches apart from the branch where the account was opened are not allowed.

•Interest income will be deducted 15% interest tax. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com |

| Other |

- |

2. Fixed Deposit

| Product name |

DR: Fixed Deposit |

| Benefits |

Deposits according to the period of time with interest rates higher than Savings Account |

| Interest rate (%p.a.) |

1.150% - 2.300%* based on deposit term As of 19 October 2023)

(*Interest rate can be changed. Please refer to the effective announcement at www.icbcthai.com) |

| Interest Rate Detail (% p.a.) |

| Deposit Period |

Interest Rate (% p.a.)* |

| 1 Months |

1.150% |

| 3 Months |

1.600% |

| 6 Months |

1.800% |

| 12 Months |

1.900% |

| 18 Months |

2.100% |

| 24 Months |

2.250% |

| 36 - 48 Months |

2.300% |

|

| Deposit Term |

1, 3 , 6 , 12, 18, 24 and 36 - 48 Months |

| Initial deposit amount (Baht) |

• 50,000 Baht

• To receive periodic interest payment, the amount of each deposit shall not be less than 500,000 Baht with a minimum deposit period of 6 months. |

| Interest rate for non-compliant deposit |

The Bank will pay interest at the rate of 0.20% p.a. to the actual deposit period if the deposit is withdrawn prior to its maturity date. |

| Account renewal upon maturity |

On the maturity date, if the Customer has not otherwise notified the Bank, it shall be considered that the Bank will pay interest at the rate of 0.20% p.a. calculated on the actual numbers of day elapse as from the maturity date. |

| Account maintenance fee |

None |

| Condition |

- |

| Warning |

•Withdrawals at any branches apart from the branch where the account was opened are not allowed.

•Interest income will be deducted 15% interest tax. |

| Contact us |

Call ICBC (Thai) Center at 0 2629 5588 or visit any branches nationwide or visit www.icbcthai.com. |

| Other |

- |

Deposit Product Catalog (Personal)

|