Established on 26 August 1969 as a commercial company, the company later obtained a license to undertake finance and securities business from the Ministry of Finance on 26 October 1973 and was listed on the Stock Exchange of Thailand (SET) in 1978. On 23 December 2005, the Bank was granted a commercial bank license from the Ministry of Finance.

On 21 April 2010, the Industrial and Commercial Bank of China Limited (ICBC), the largest commercial bank in the world in terms of market capitalization, acquired 97.24% of the total issued shares of the Bank from a voluntary tender offer of all shares traded on the SET and changed the name of the Bank to “Industrial and Commercial Bank of China (Thai) Public Company Limited” becoming a part of the ICBC Group. On 19 March 2011, the Bank delisted from the SET. At present, the ICBC holds 97.98% of the total shares sold of the Bank.

As a fully licensed commercial bank, the Bank aims to be on the forefront of commercial banks in Thailand on international banking service. Being a part of the ICBC Group means customers of the Bank are able to fully utilize the services provided by the Group’s network which is growing at a rapid pace in China as well as around the world. As of the end of June 2024, ICBC Group had 15,453 branches in China, Self-service banks in China 20,517 locations and 410 overseas branches in 49 countries. In addition, ICBC had 1,458 correspondent banks in 143 countries worldwide.

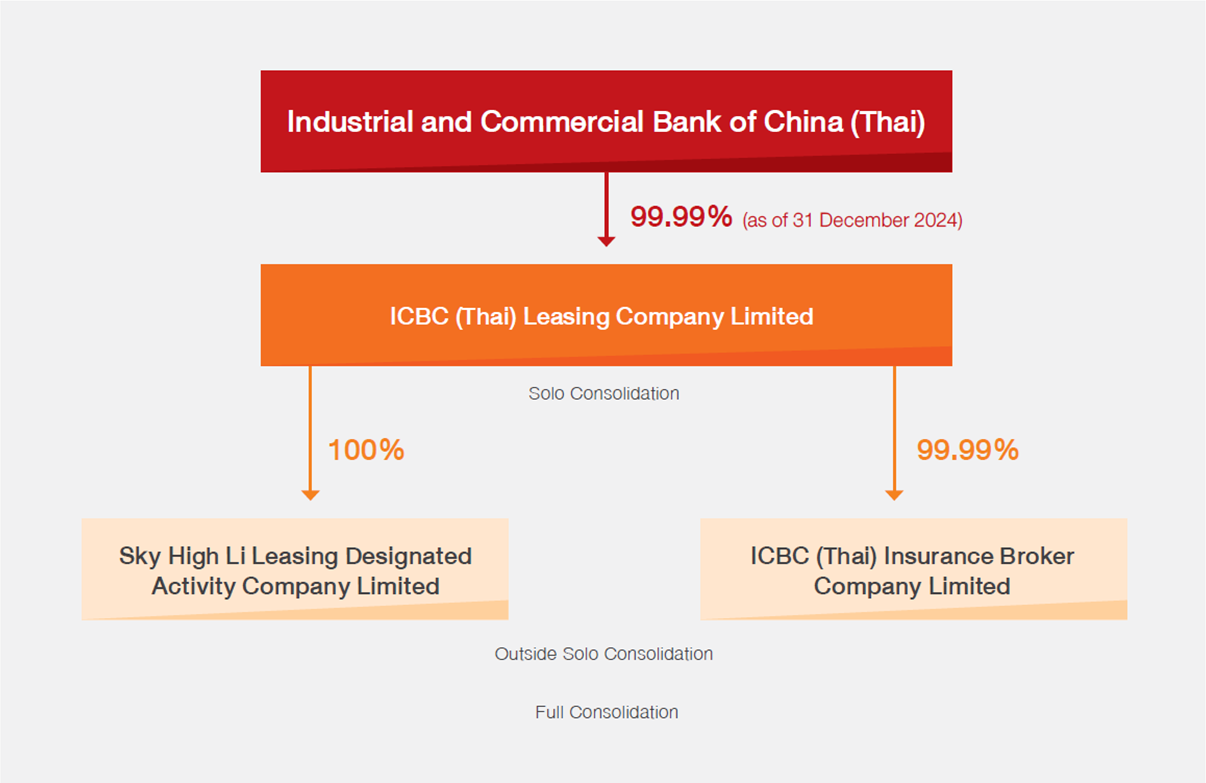

At present, the Bank has 3 subsidiaries, ICBC (Thai) Leasing Company Limited, which the Bank owns 99.99%, the company offers leasing and hire purchase services, Sky High Li Leasing Designated Activity Company Limited and ICBC (Thai) Insurance Broker Company Limited.

Throughout its operations in Thailand, the Bank continues to strive at providing the best financial services to its customers by developing various new and innovative products and services in order to answer the needs of its customers. In particular, the Bank has expanded its products and services to both juristic person customers, to facilitate their business needs, and individual customers, to reflect their lifestyles such as new types of credit cards, debit cards, internet banking, mobile banking, POS machines and CNY 1 day remittance. At present, the Bank has a total of 21 branches across Thailand. ICBC (Thai) has been appointed as the RMB Clearing Bank in Thailand since 2015 and continues to hold its credit rating by Fitch Ratings at the highest attainable rating of AAA(tha) for National Long-Term Rating for the thirteenth consecutive year affirming it’s sound financial position.

Shareholders’ structure of ICBC (Thai) Group

|